Acquirers have to meet the deadlines, too, and they may move up the merchant’s deadline to buy themselves a little more time.įor example, a Chase Bank cardholder will only have 60 days to dispute a transaction, despite the network’s limit being 120 days. That may sound like plenty of time, but there are other considerations.Īs we mentioned earlier, it’s not just the card networks who can control the time frames for chargebacks. The merchant will normally have a maximum of 30-45 days in which to respond to any given phase. We’ll help you navigate the shifting chargeback landscape. How Long Do Cardholders Have to File a Dispute?Ĭhargeback Time Limits Are Confusing. Even the reason for the chargeback can affect the deadline, on top of any of the other wild cards.Īll things considered, calling it confusing is an understatement. Chargeback time limits for merchants can vary by card scheme, location, processor, bank, product category, and other factors. Unfortunately, these rules are not universal. There are specific time limits for merchants, as well.

Card schemes, for example, usually give cardholders 120 days to dispute a charge.

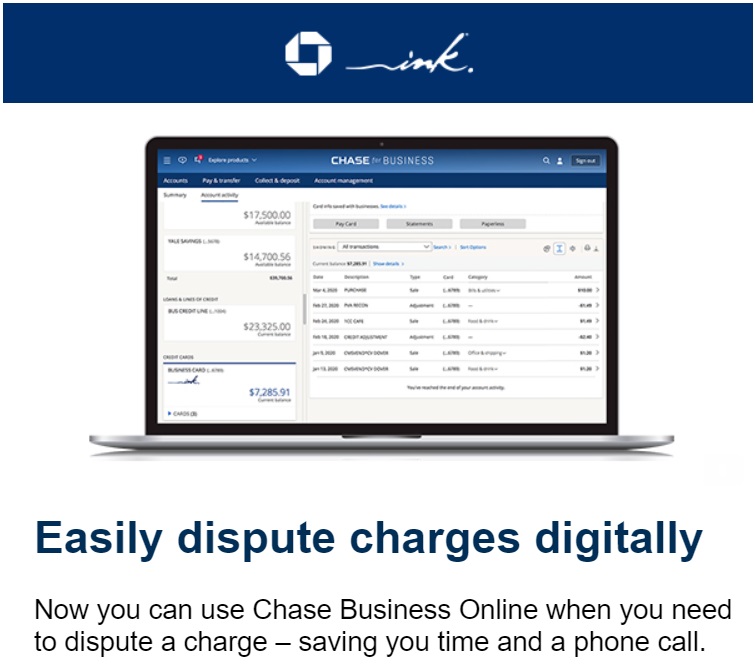

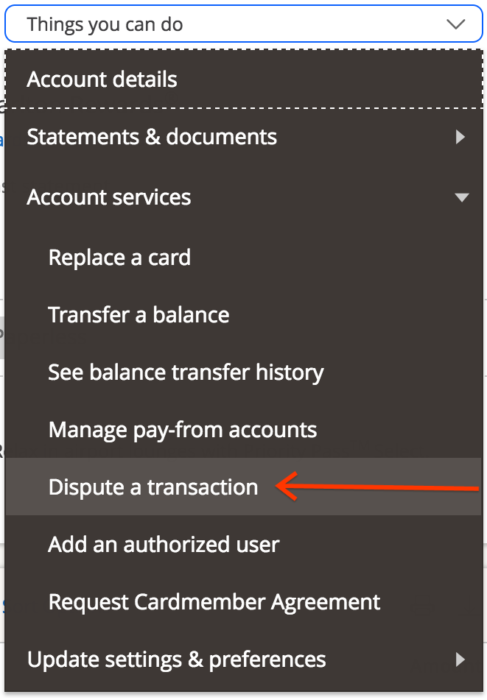

The Fair Credit Billing Act of 1974 mandates that all cardholders have a minimum of 60 days to dispute illegitimate charges.īanks, processors, and the card networks can set their own deadlines, though, as long as they meet the minimum requirements under the law. The entire chargeback process was designed as a safety net to protect consumers from fraud and dishonest merchants. What Are Chargeback Time Limits? Why Impose a Time Limit on Chargebacks?

0 kommentar(er)

0 kommentar(er)